IPO Grey Market Premium (IPO GMP)

Upcoming IPO Reviews and Grey Market Premium

List of recent IPOs with GMP, Kostak and Subject to Sauda Price. Please refer to these details and decide whether to subscribe to an IPO or not.

| IPO Details | Subscription Details | Listing Details | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| IPO Name | IPO Date | Issue Price | Lot Size | Issue Size (in crores) | GMP | Kostak Price | Subject to Sauda | Recommended? | QIB | HNI | RII | Total | Listing Date | Listing Open | Listing Gains(%) |

| Vishal Mega Mart | 11 Dec 2024 - 13 Dec 2024 | 74-78 | 190 | 8000 | 13-14 | 800 | 1600 | yes | 18 Dec 2024 | ||||||

| Mobikwik | 11 Dec 2024 - 13 Dec 2024 | 265-279 | 53 | 572 | 64-65 | yes | 18 Dec 2024 | ||||||||

| Sai Life Sciences | 11 Dec 2024 - 13 Dec 2024 | 522-549 | 27 | 3,042.62 | 30-31 | no | 18 Dec 2024 | ||||||||

| Uniparts India | 30 Nov 2022 - 02 Dec 2022 | 548-577 | 25 | 835.61 | 72-75 | 450 | 2500 | yes | 12 Dec 2022 | ||||||

| Dharmaj Crop | 28 Nov 2022 - 30 Nov 2022 | 216-237 | 60 | 251.15 | 43-45 | yes | 08 Dec 2022 | ||||||||

| Aether Industries | 24 May 2022 - 26 May 2022 | 610-642 | 23 | 808.04 | yes | 03 Jun 2022 | |||||||||

| Paradeep Phosphates | 17 May 2022 - 19 May 2022 | 39-42 | 350 | 497.73 | yes | 27 May 2022 | |||||||||

| Ethos | 18 May 2022 - 20 May 2022 | 836-878 | 17 | 472.29 | yes | 30 May 2022 | |||||||||

| eMudhra | 20 May 2022 - 24 May 2022 | 243-256 | 58 | 412.79 | yes | 01 Jun 2022 | |||||||||

| Venus Pipes | 11 May 2022 - 13 May 2022 | 310-326 | 46 | 165.42 | 28-30 | 300 | 800 | yes | 12.02 | 15.66 | 19.04 | 16.31 | 24 May 2022 | ||

What is IPO Grey Market?

The grey market - or, the illegal premium market for initial public offerings (IPOs) was back after almost a decade.

After its death almost 10 years ago, the the grey market was reborn in August, 2004 with Tata Consultancy Services (TCS) Ltd issue.

It is a completely illegal market where stocks are traded even before allotments in the IPOs are made. In fact, the unofficial trading begins well before the scrip is listed.

The transaction in this market is normally between parties who know each other very well. They trade in scrips unofficially and settle accounts outside of the stock exchanges once the allotments by the companies are decided.

Normally, third parties are not part of such trading.

However, a third party is entertained only if he is introduced through a person known in the circuit.

Two parties agree to settle the trade at a price on the day of listing through the stock market mechanism and the difference is settled through cash, explained broking industry sources.

A robust secondary market has aided this trend and players in this segment are doing brisk business across centres. Ahmedabad is the most active grey market centre while Kolkata, Delhi and Mumbai are also some of the centres where grey market for IPOs is alive and kicking.

A dealer with a brokerage house said, The future of the grey market for the IPOs is linked with the robustness of the secondary market. Till the time the cash market is in the pink of health, this grey market will flourish and the moment a downturn is signalled in the cash market, the grey market downturn will be faster than that of the cash market. In such an event, the premium market will disappear altogether.

Top 5 Reasons Why you should invest in IPO?

These are top 5 reasons why you should invest in IPO.

- If you are new to stock market and you want to test the water, start with IPO. It is less risky compared to already listed stock market.

- It will help you learn the stock market without having to burn tons of money.

- Never invest in more than one lot. If it is a good IPO, you won't be alloted more than one lot even if you have applied for full quota.

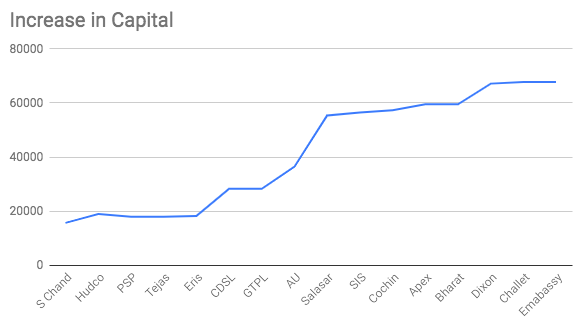

- Your less than Rs.15,000 could have made you Rs.67,744.75 in the financial year 2018 - 2019. That's whopping 350% increase in your capital. Assumption of course is you have applied for every single IPO and you were alloted all of them. Of course this is not practical but shows you the potential in IPO investment.

See below on analysis of listing gain.

IPO Listing Gain Analysis - Financial Year 2018 - 2019

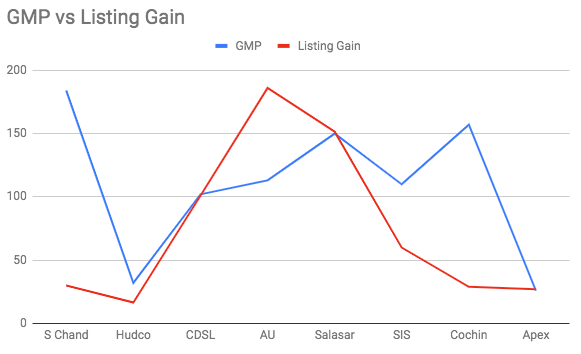

- There is a strong relationship between IPO Grey Market Premium and Listing Gain. This makes it easy to predict market. Please find below the analysis on that. You can also use 'Subject to Sauda' and 'Kostak' to decide whether to invest in a particular IPO or not.

Relationship between IPO GMP and Listing Gain %

IPO Grey Market FAQs

-

What is the meaning of IPO?

The full form of IPO is initial public offering. It is the first time, the stock of a private company is offered to the public. IPOs are often issued by smaller, younger companies seeking capital to expand, but they can also be done by large privately owned companies looking to become publicly traded.

-

What is IPO Gray Market?

A grey market (sometimes called a parallel market, but this can also mean other things; not to be confused with a blackmarket or a grey economy) is the trade of a commodity through distribution channels that are legal but unintended by the original manufacturer.

-

What is IPO Grey Market Premium(GMP) Price?

GMP is Grey market premium (or grey market price) is a premium amount in rupees at which IPO shares are being traded in Grey Market before they get listed in stock exchange. Grey market premium can be in positive or in negative based on demand and supply of the stock. Grey Market Premiums are also attached with words 'Buyer' or 'Seller'. They tell the price either at which buyers are willing to buy shares or the price at which sellers are willing to sell their IPO shares.

-

What is Kostak Price?

Kostak (or price of application) is the premium amount in rupees at which IPO applications are being traded in IPO Grey Market. Usually 'Kostak' value is defined as the premium of a maximum lot retail application in an IPO. Kostak price is important mostly before issue is close for subscription and final bidding status is available to the IPO investors. Very few IPOs applications are traded after final bidding status is available to the investors. 'Kostak' is especially for people who do not want to take risk with IPO allotment or listing gains.

-

What is Subject to Sauda Price?

Subject to Sauda (or price of application subjected to sauda) is the amount in rupees at which IPO applications are being traded in IPO Grey Market subjected to the seller being alloted the lot. Usually 'Subjected to Sauda' value is slightly less that what can be the actual listing gain. if 'Subject to Sauda' value is high you can expect a good listing gain as well. If you are not a risk taker and would rather cash in the money, you can decide to sell your application in the grey market.

-

What is the Basis of IPO allotment?

In August 2012 SEBI has made regressive changes in the allotment procedures. As per these changes, every retail applicant will get a certain number of shares, though it is subject to the availability. It clearly means that retail investors are now assured to get minimum number of shares at a decided ratio irrespective of the lots they have applied, subject to availability. However remaining shares will be allotted proportionately. Current procedure is quite encouraging for retail investors as now they have assurance of getting shares in IPO. As per this practice every investor has equal probability of getting shares in an IPO irrespective of the lots he applied in an oversubscribed issue. Even if he applied for minimum permissible lot he may get minimum number of stocks allotted to shareholders. In fact retail investors who apply for smaller lots may have a better chance of getting more number of shares than the investors who applies for maximum amount permissible.

We analyze lot of websites over internet and give you the recommendation based on GMP (Grey Market Premium), Kostak and lot of other factors like company fundamentals etc. Though Grey Market Premium itself is not the only factor to be considered while deciding the purchase of IPO but it definitely helps you maximize your listing gain.

Please write if you have any suggestions or comments for this website. We will be happy to take your suggestions and improve our website.